All your

Investments,

in one

View

Manage your investments like the pros.

Portfolio tracker platform for a diverse range of assets.

Powerful dividend and money tracking.

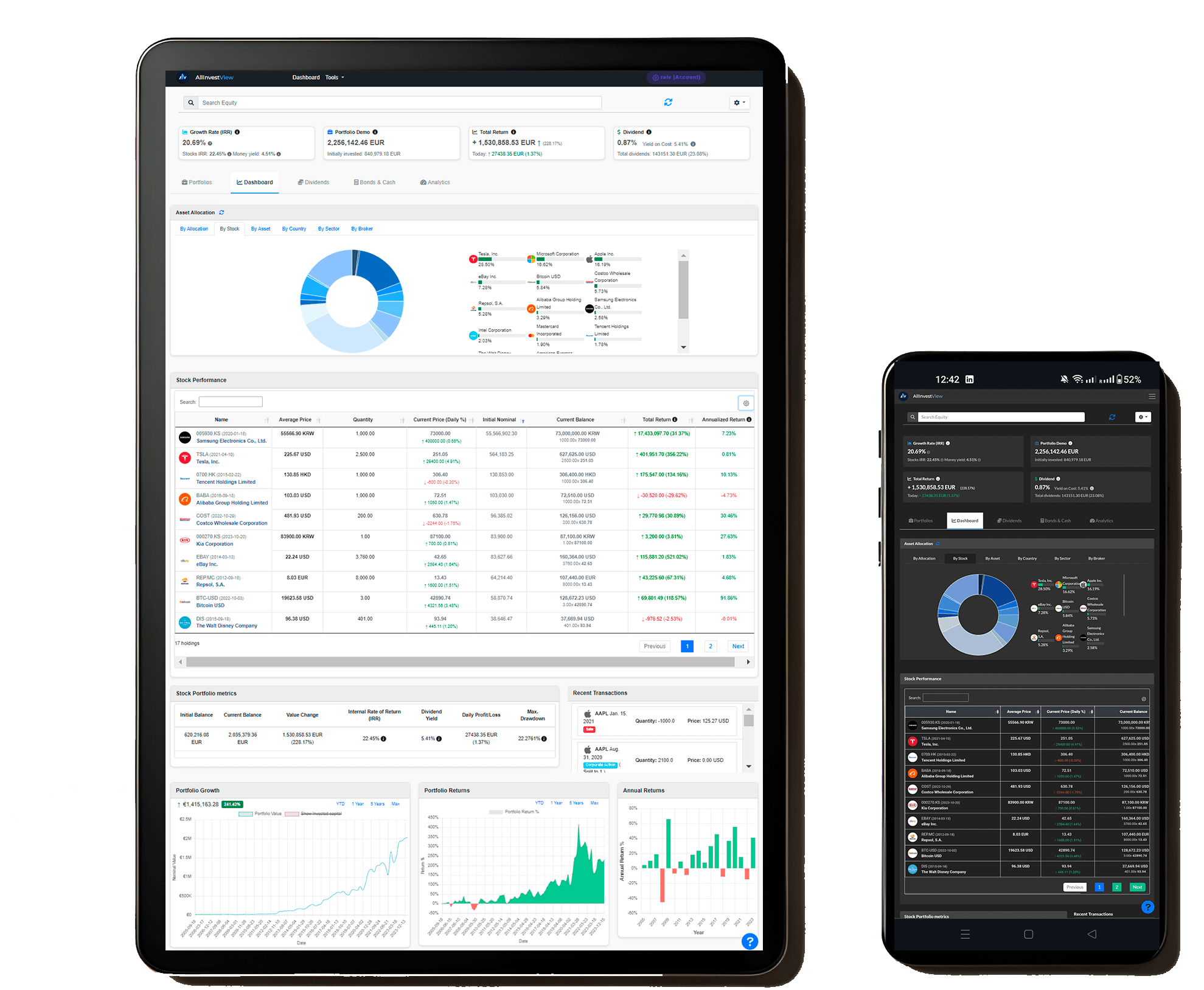

Intuitive and simple user interface.

Track your investments, anytime, anywhere

Invest like the pros. More insight, less effort.

Investment Control

Bring all your investments under one roof. Say goodbye to the hassle of managing multiple platforms and spreadsheets.

Monitor any asset

Track any stock, ETF, mutual funds or crypto from anywhere. Manage Dividends, Money & Fixed income with our bond pricing module.

Your Data is Yours

Enjoy a secure platform where your information is protected and never shared. No third parties, no ads, no upselling. Import and export your data at anytime

Insightful Analytics

Explore your investments with personalized insights that reveal your performance, diversification, and much more.

1k+ users

Be an early adopter and join our trusted community of investors.

200k+ assets

Embrace diversity with over 200k+ stocks, ETFs, bonds, funds, and cryptocurrencies.

50+ currencies

Track your investments across multiple currencies and assess your performance in your preferred currency.

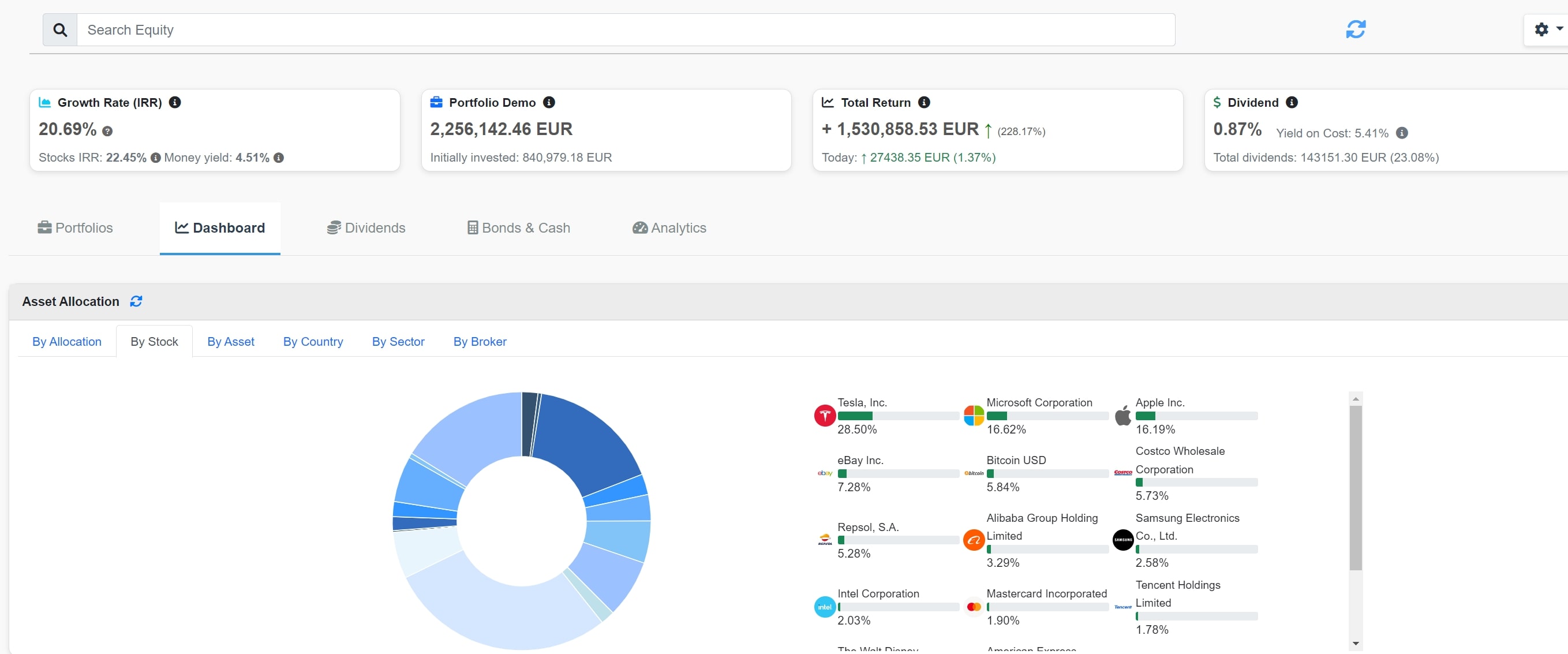

Intuitive and Simple Interface

See your investment allocations clearly. View distributions by individual stocks, countries, industries, or brokers for a comprehensive understanding of your portfolio's composition.

Dividend Management

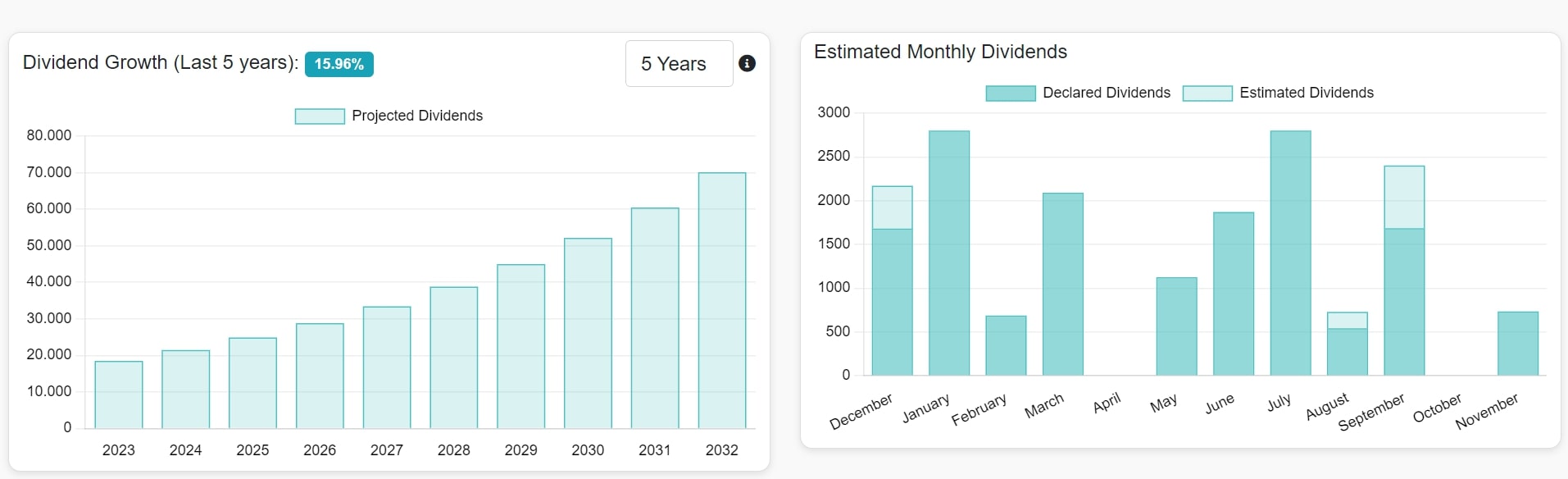

Dividend Analytics

Understand yield on cost and assess dividend returns per holding across multiple currencies.

Track Dividends

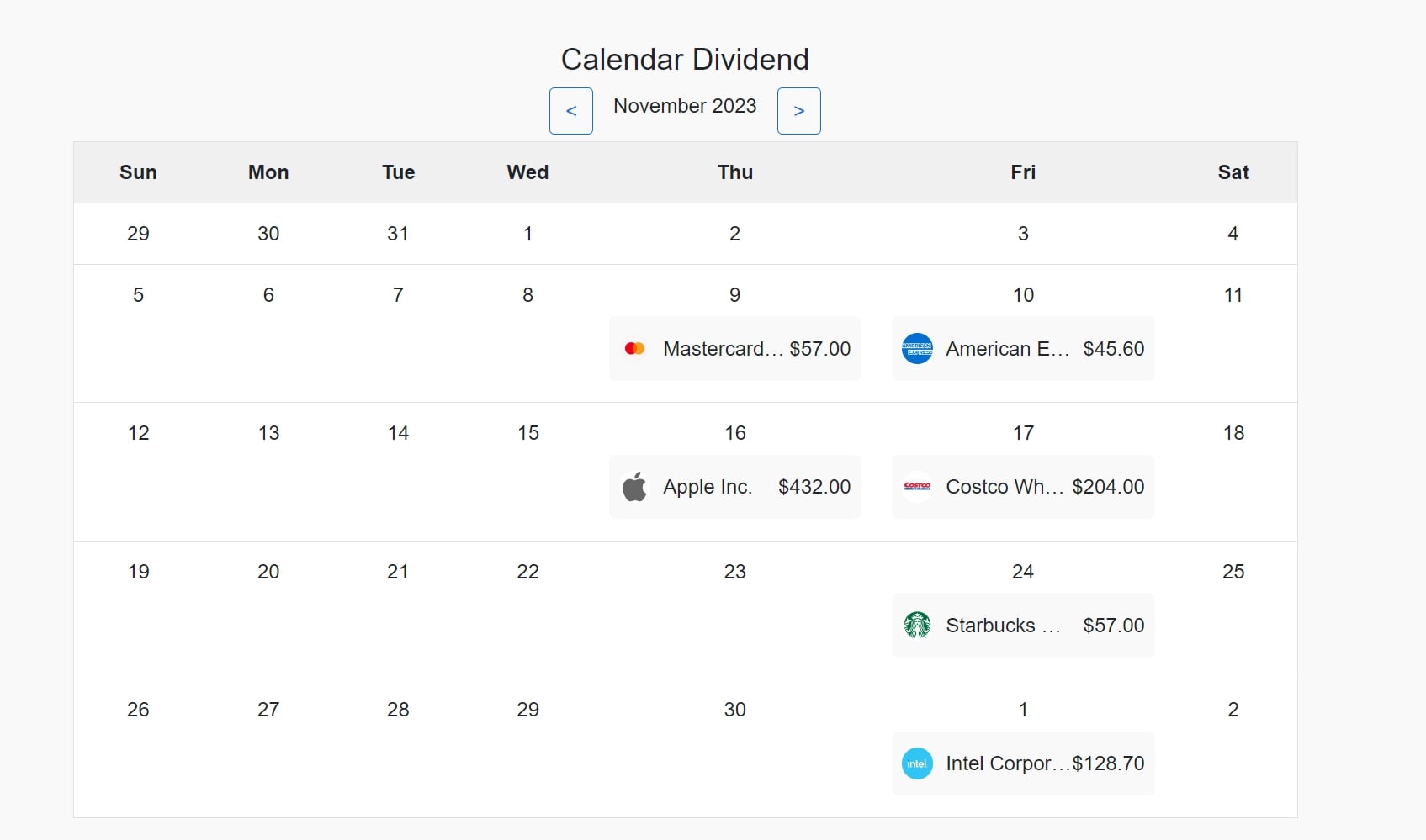

Monitor upcoming and past dividends from your stock holdings. Always be in the loop of your dividends.

Dividend Calendar

Manage and track dividends with a dividend calendar, ensuring timely investment planning and income tracking.

Advanced Dividend Graphs

Visualize your earnings trends and upcoming dividend dates for strategic planning.

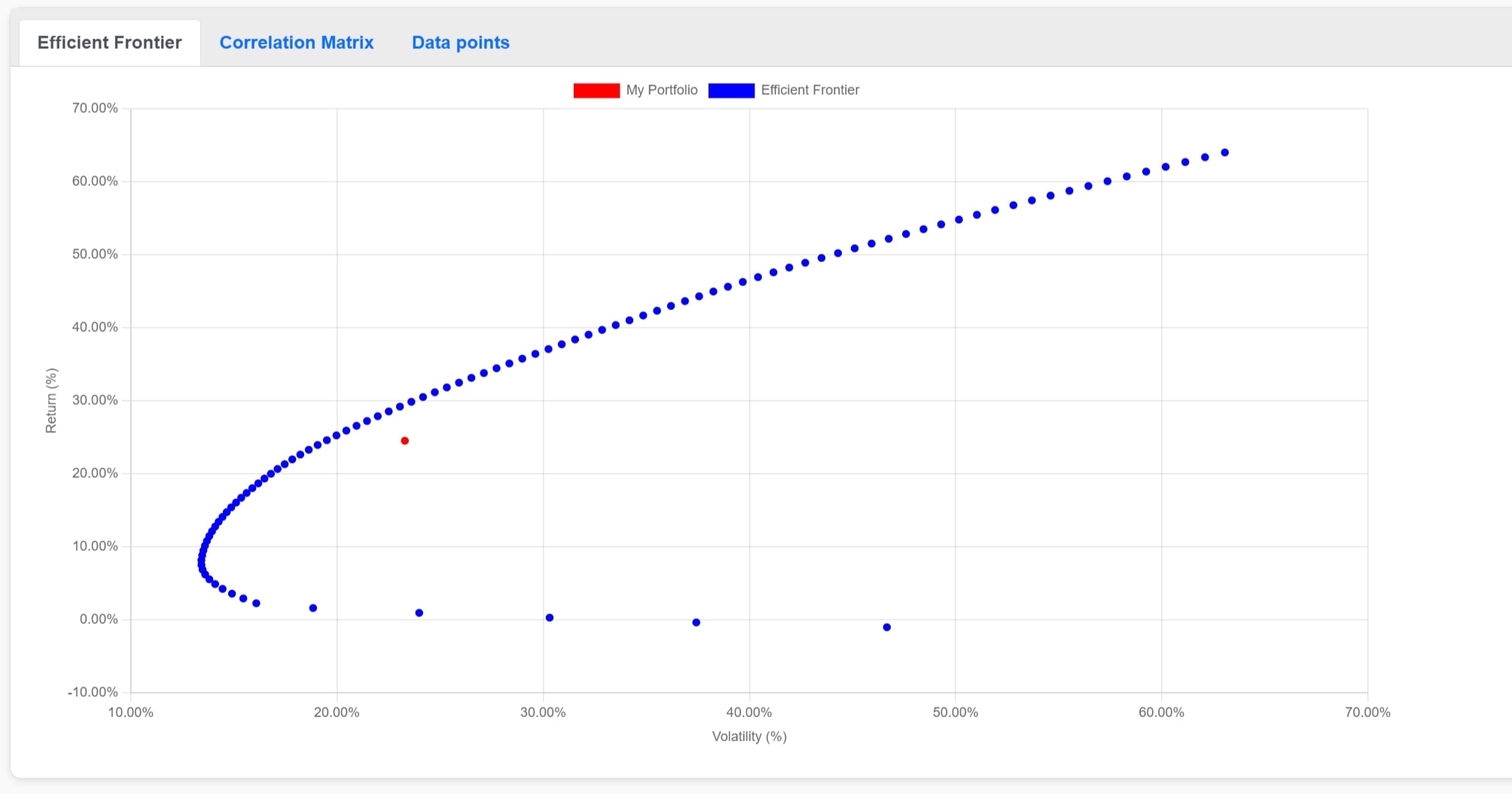

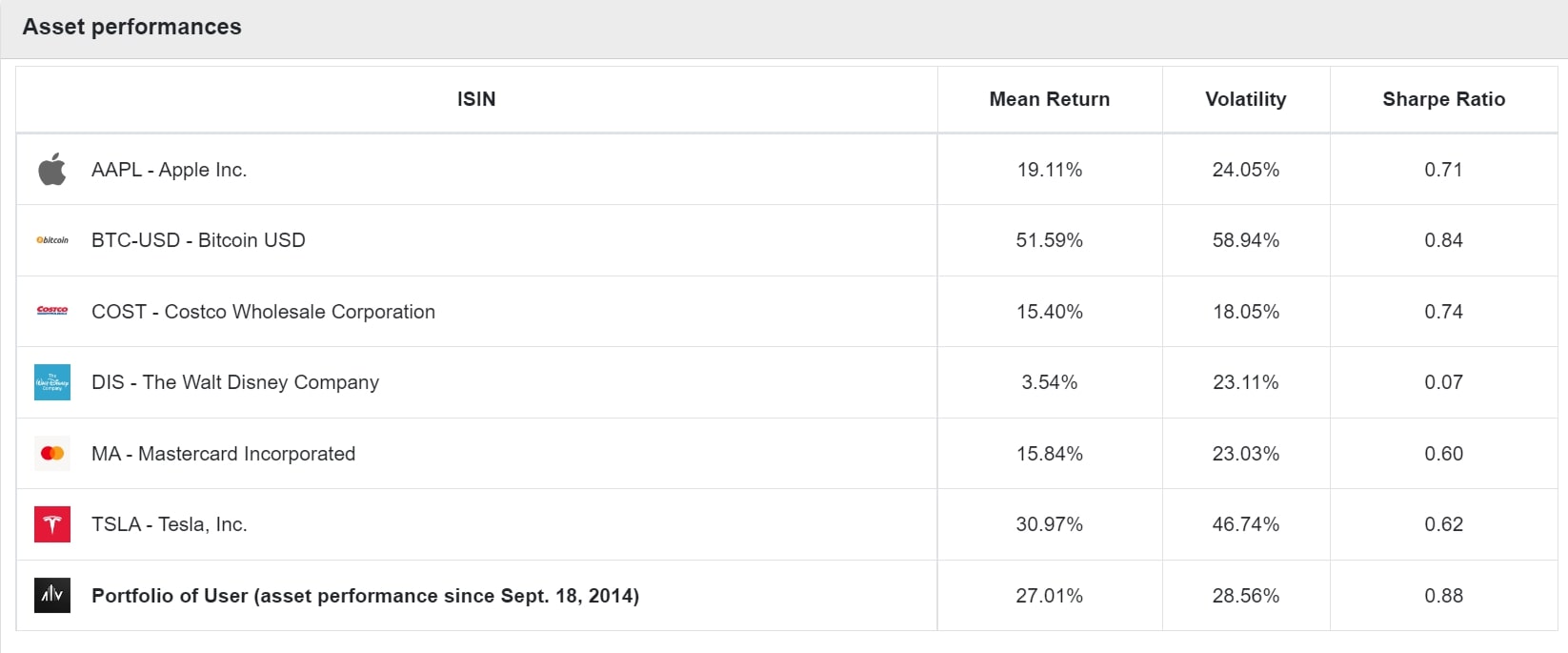

Portfolio Management Analytics

Explore the depths of your investment strategy with cutting-edge portfolio analysis tools, including Efficient Frontier and Correlation Matrix.

Efficient Frontier Analysis

Maximize your returns for a given risk level.

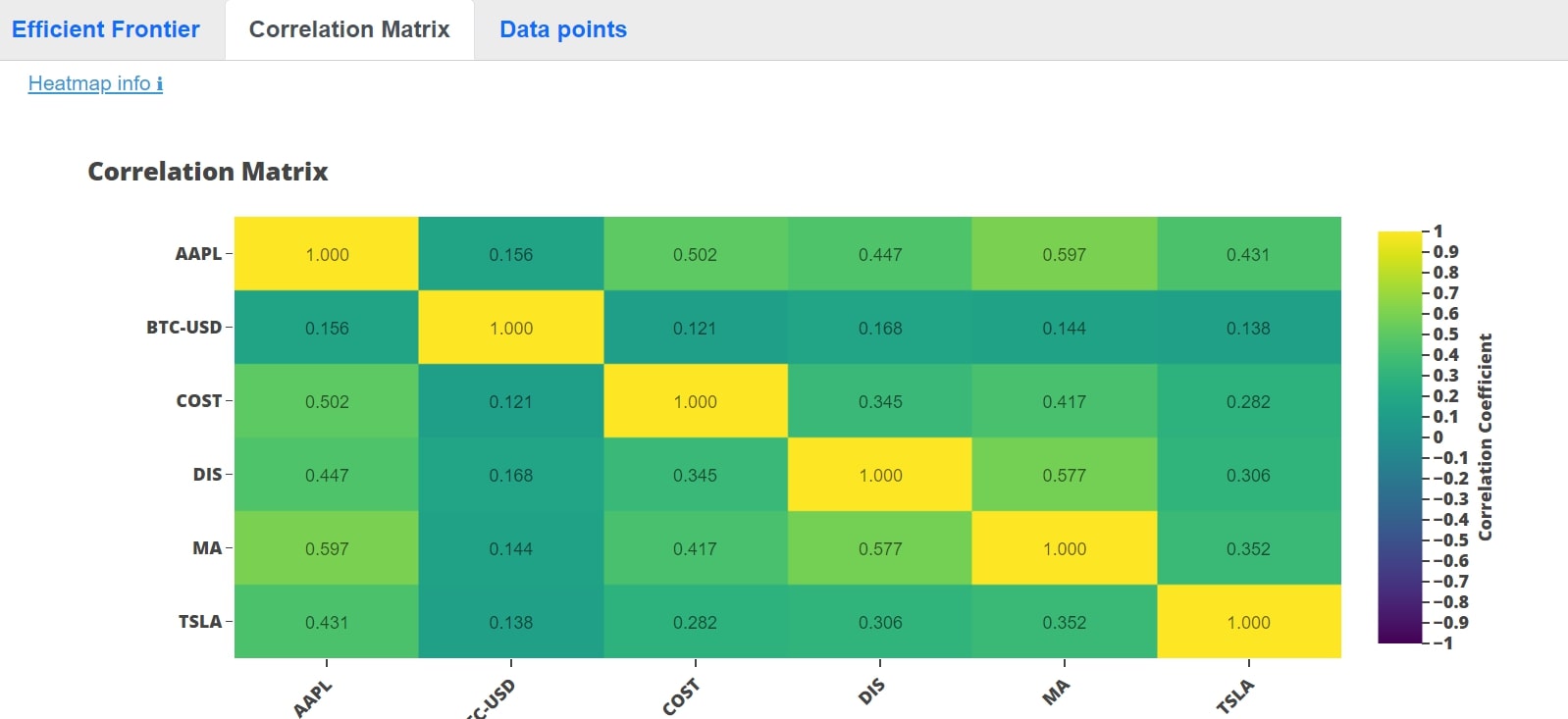

Correlation Matrix

Analyze asset relationships. Utilize color-coded heatmaps for intuitive diversification and risk management.

Strategic Asset Allocation

Identify the optimal asset mix to balance returns and risk, tailored to your investment goals and risk profile.

Diverse Asset Classes

From stocks to custom assets, AllInvestView supports a wide range of asset classes.

Bonds

Access our bond calculator and specialized fixed income tools.

Stocks

Equity ownership in corporations.

ETFs & Funds

Diverse range of assets in one package.

Crypto

Cryptocurrencies and digital assets on the blockchain.

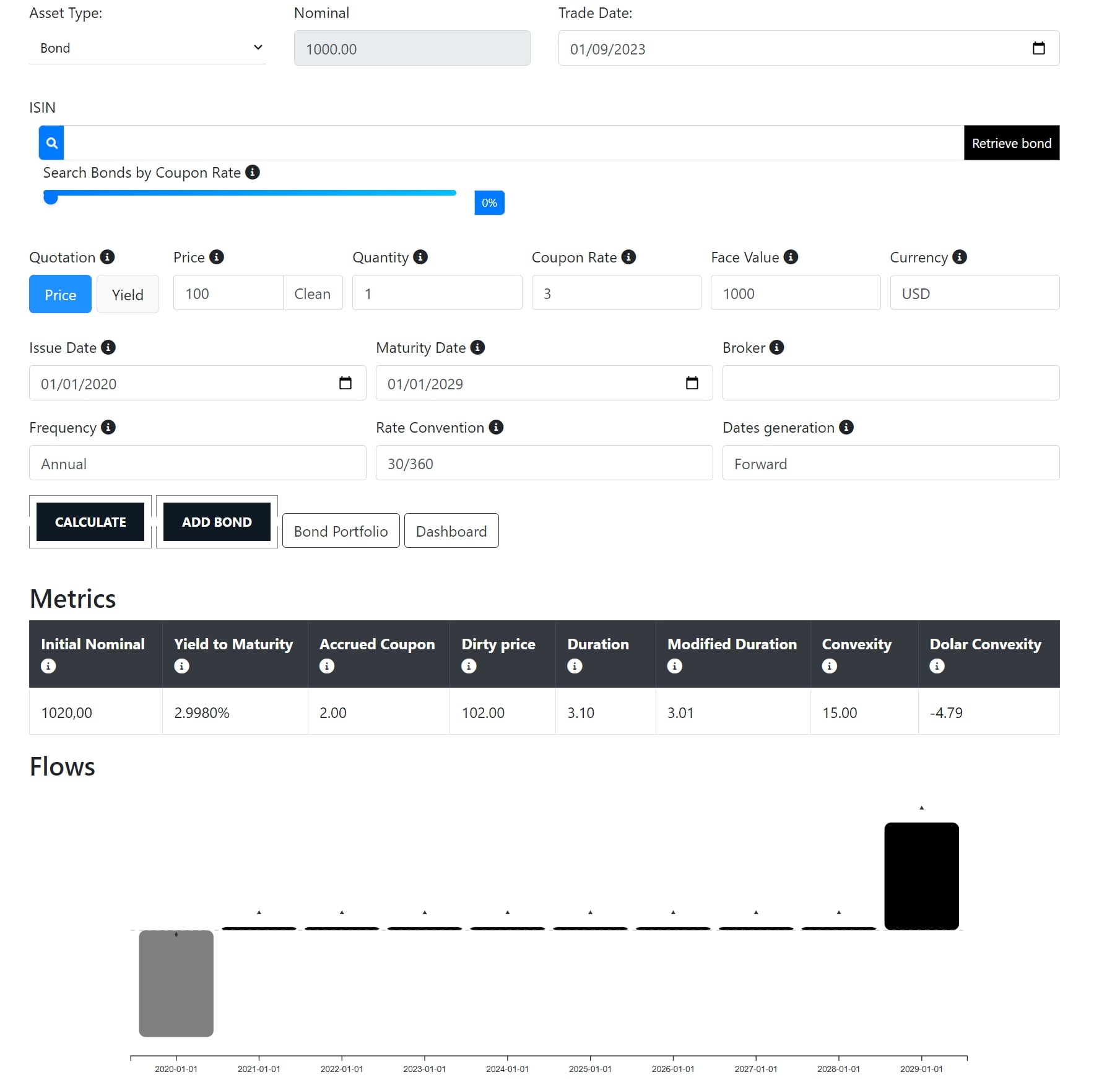

Bond Calculator

Bond Pricing

Accurately determine the value of your bonds using our advanced calculator.

Visualize Advanced Metrics

Gain insights into bond metrics such as accrued coupon, yield to maturity, duration or convexity.

Bond Management

Tools to manage individual bonds and bond ladders efficiently.

Search & Discover

Explore the extensive bond database to find bonds that match your criteria.

Coupon Flows

Visualize all your bond coupon flows, ensuring you never miss a payout and understand your cash flow.

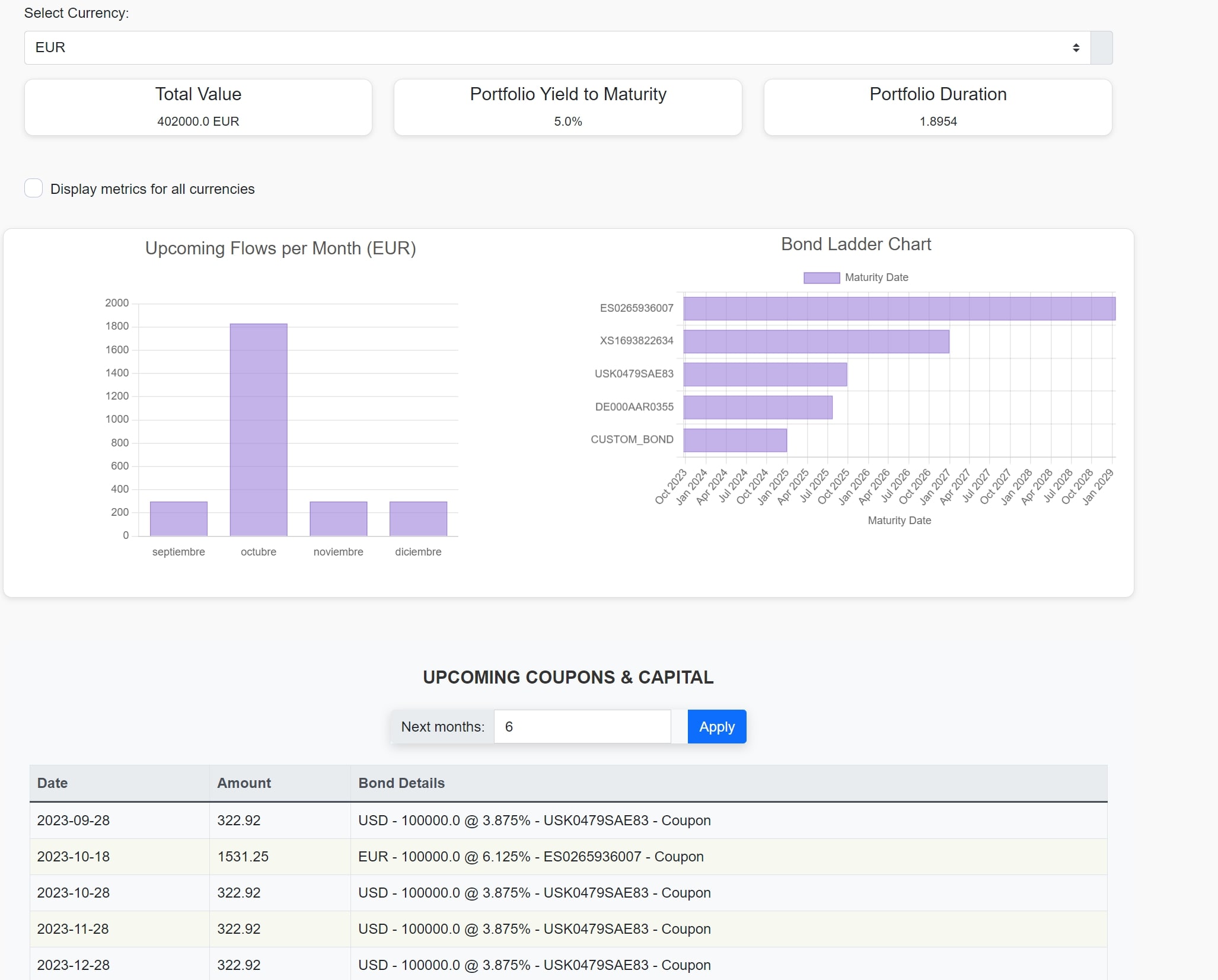

Try the CalculatorBond Ladder Visualization

Understand your investment horizon with an intuitive chart representation of your bond maturities.

Upcoming Coupons

Stay updated with your upcoming bond coupon payouts to manage and forecast your cash flows.

Advanced portfolio metrics

Gain insights into your total bond portfolio metrics such as yield and duration.

Filter & Explore

Filter and explore upcoming payouts based on customizable time frames.

Integrated Bond Details

Access detailed bond specifications right from your upcoming coupons list.

Exciting Features on the Horizon

We're constantly working to enhance AllInvestView platform.

Ready to Take Control of Your Investments?

Start tracking your performance for free.

Sign up for free